US comes up with two necessary IRP use pricing fashions underneath Trump’s MFN technique

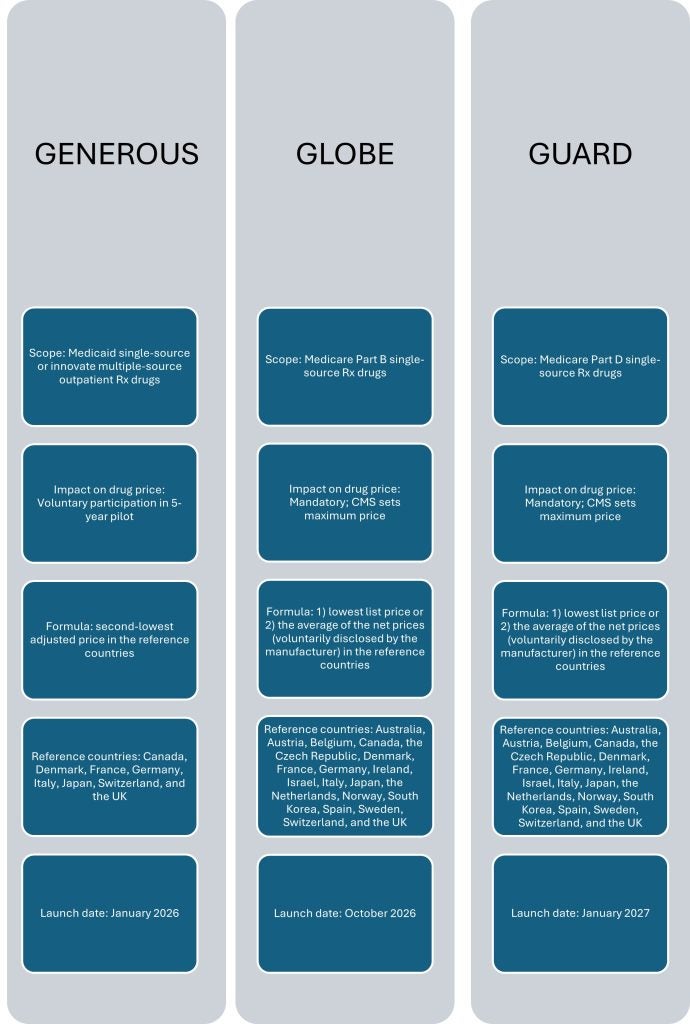

Simply earlier than Christmas 2025, the US Facilities for Medicare and Medicaid Providers (CMS) unveiled two pricing fashions primarily based on the usage of worldwide reference pricing (IRP). These fashions—nicknamed GLOBE and GUARD—advance President Donald Trump’s most favored nation (MFN) price-setting agenda for medicines, and signify a way more severe menace to pharmaceutical business income within the US and to affected person entry to medicines globally than the GENErating price Reductions fOr U.S. Medicaid (GENEROUS) mannequin introduced in November.

The GENEROUS mannequin was already a menace. It envisaged taking the usage of IRP within the US far past the kind of IRP Trump tried to implement throughout his first time period in workplace. GlobalData’s detailed strategic stories on the MFN government order and on the GENEROUS mannequin examined how a number of the recognized opposed results of IRP will likely be unleashed by way of pricing strain, misplaced revenues, and delayed or cancelled drug launches, whereas outlining the methods pharma firms may make use of to cut back such impacts. Nevertheless, the GENEREOUS mannequin had one key benefit over the brand new fashions: it was voluntary for pharmaceutical firms. It additionally had a narrower software by focusing on Medicaid medication solely.

The 2 newly launched IRP fashions are as an alternative necessary and goal the costs of medication bought underneath the bigger Medicare applications for over-65s. GLOBE, whose full identify is World Benchmark for Environment friendly Drug Pricing, targets Medicare Half B medication (basically prescription [Rx] medication administered in docs’ practices or clinics) and comes into impact in October 2026. GUARD (quick for Guarding US Medicare In opposition to Rising Drug Prices) will apply to Medicare Half D—i.e., all outpatient prescribed drugs lined underneath the reimbursement program for seniors—and is ready to launch in January 2027. Crucially, these two fashions will likely be necessary for all firms that haven’t entered a voluntary MFN settlement with the US authorities. Medicines whose costs are already negotiated and minimize underneath the Inflation Discount Act (IRA) provisions can even be spared. Nevertheless, these are small exemptions. For all intents and functions, IRP is ready to grow to be the primary pricing mechanism for all originator/single-source prescriptions medication lined underneath the biggest publicly funded reimbursement program for prescribed drugs within the US. And with this, there can even come a heightened danger of worth leakage from Medicare to non-public sector reimbursement plans for medicines—additional intensifying the strain on pharma firms’ backside traces.

Determine 1: Chosen parts of US IRP system underneath the three fashions

The pre-Christmas announcement was the precise reverse of a Christmas current for a weary pharma business that has carried out its greatest to appease an more and more hostile and belligerent Trump administration. There have been quite a few business makes an attempt—examined in GlobalData’s Worth Intelligence (POLI) and World Markets Healthcare (WMH) every day analyses—to supply voluntary concessions in an effort to avert the introduction of a proper, necessary IRP system within the US. The disclosing of GLOBE and GUARD means that such makes an attempt have failed and the US is ready to maneuver in the direction of the formal use of IRP.

The pharma business does, nonetheless, nonetheless have instruments at its disposal to steer the Trump administration to switch its IRP plans. Pharmaceutical firms are already doing sure issues that may mitigate the income hit—most notably by using direct-to-consumer (DTC) gross sales methods. DTC promoting permits firms to bypass the wholesale and retail sectors, permitting the advertising authorisation holder to retain a better share of revenues from every product.

Nevertheless, there’s extra that may be carried out, particularly in relation to IRP and utilising its parts to cut back income headwinds, each within the US and in different international locations, whose worth ranges will likely be impacted by the US’ use of IRP. MFN plans could also be new for the US, however IRP has been used extensively world wide. Greater than 75 international locations already use IRP to both straight set drug costs or as one among a number of inputs into worth negotiation. GlobalData’s detailed IRP nation profiles, analyzing each side of the actual nation’s IRP system parts, present a helpful indicator of how the US IRP system might evolve. POLI knowledge on launch sequencing in the meantime permits exact measurement of IRP’s impression on firm methods. IRP reform impression may be separated from that of concurrent pricing and reimbursement reforms and from the launch delays triggered by the pricing and reimbursement approval course of in every market.

One other essential component that may assist with pharma business advocacy efforts is the expertise with drug shortages and examples of how totally different international locations world wide have amended their pricing and reimbursement insurance policies, together with the usage of IRP, in response to shortages. There may be ample proof of such impacts in GlobalData’s 25 years’ price of every day analyses, which may assist advocacy efforts, whereas knowledge on shortages on the drug pack degree is captured in POLI. Simply two pertinent examples to say listed here are the choice within the Netherlands to cap worth cuts triggered by its IRP reference international locations basket reform in 2020, and the delay to Canada’s IRP reform following business pushback and issues about drug shortages. Canada not solely delayed altering its reference nation basket by a number of years, however, in an sudden twist, introduced in 2025 that it’ll reference the very best worth amongst its reference international locations as an alternative of the median.

Coverage modifications are potential when the opposed results of IRP, together with strain on drug provide, grow to be evident to policy-makers.

This text is produced as a part of GlobalData’s Worth Intelligence (POLI) service, the world’s main useful resource for world pharmaceutical pricing, HTA and market entry intelligence built-in with the broader epidemiology, illness, scientific trials and manufacturing experience of GlobalData’s Pharmaceutical Intelligence Middle. Our unparalleled staff of in-house consultants screens P&R coverage developments, outcomes and knowledge analytics world wide each day to provide our purchasers the sting by offering important early warning indicators and insights. For a demo or additional data, please contact us right here.