South Korea emerges as 2025 licensing hub with 113% development and billion-dollar offers

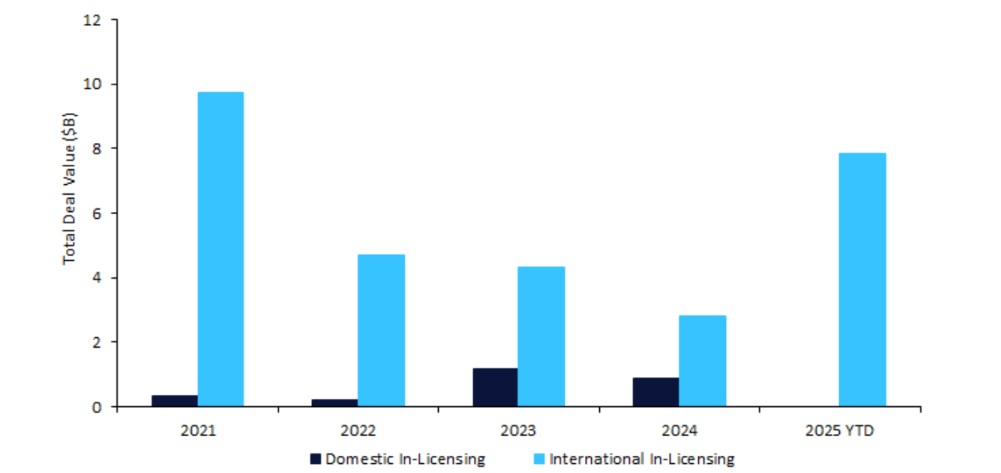

South Korea’s biopharmaceutical sector has seen a surge in innovator drug licensing agreements, reaching a complete deal worth of $7.86bn in 2025 year-to-date (YTD), at a 113% improve from 2024, based on GlobalData’s Pharmaceutical Intelligence Middle Offers Database. This restoration is pushed by billion-dollar agreements with massive pharma corporations comparable to Eli Lilly and GSK, and follows a dip to $3.67bn final 12 months as a consequence of broader macroeconomic challenges.

The robust momentum displays the sector’s resilience and rising worldwide attraction. A lot of that is supported by proactive authorities initiatives. In January 2025, the Nationwide Bio Committee – an advisory physique guiding South Korea’s biotech and life science trade – was launched to strengthen the nation’s international competitiveness in novel drug and superior biopharmaceutical expertise improvement. This transfer builds on ongoing reforms as the federal government goals to scale back drug improvement timelines from 13.7 years to 6 years, and to scale back prices from Won2tn to Won1tn.

Worldwide biopharmaceutical corporations in-licensed a big share of South Korean medicine, with a complete licensing settlement deal worth of $29.4bn over the previous 5 years, as Western corporations retained the biggest proportion at 79% ($23.3bn). This emphasises South Korea’s strategic place as a gateway to different Asian markets and a supply of revolutionary medicine. Whereas the out-licensing of South Korean medicine to worldwide corporations has grown 180% ($5.1bn) in worth from 2024 to 2025 YTD, home licensing has declined 100% ($879m) over the identical interval, reflecting a shift towards cross-border collaboration.

Key transactions this 12 months emphasise the worldwide demand for Korean biopharma innovation. Valued at as much as $2.78bn, GSK partnered with ABL Bio to license its Grabody-B platform, which targets neurodegenerative ailments with programmes throughout antibodies, polynucleotides, and oligonucleotides. Equally, Eli Lilly licensed Rznomics’ trans-splicing ribozyme platform for treating listening to loss in a $1.3bn settlement. These transactions spotlight Korea’s rising affect in drug supply and superior therapeutics on a world scale.

South Korea can be gaining consideration as a hub for antibody-drug conjugates (ADCs). From 2021 to 2024, the licensing of ADCs from South Korean biotechs grew by 39%, reaching $1.4bn. All ADCs have been licensed from international corporations. LigaChem Biosciences (previously LegoChem Bioscience), identified for its give attention to ADCs, secured partnerships with corporations comparable to Janssen, Amgen, and Ono Pharmaceutical, reflecting the nation’s function in next-generation oncology remedies.

As soon as identified primarily for generic drug manufacturing, South Korea is now transitioning into a world hub for novel revolutionary drug discovery and superior drug applied sciences. Backed by authorities help, the nation is attracting elevated worldwide funding and forming high-value partnerships, as seen in latest offers, thus solidifying its place as a strategic bridge between Western and Asian markets.

For additional insights into the most recent Deal Tendencies within the Pharma Sector, please see GlobalData’s Pharma Enterprise Capital Funding Tendencies, Q2 2025 and M&A Tendencies in Pharma, Q2 2025 reviews.