Prime 20 biopharmas’ market cap rises 6% in Q1 2025 amid tariff headwinds

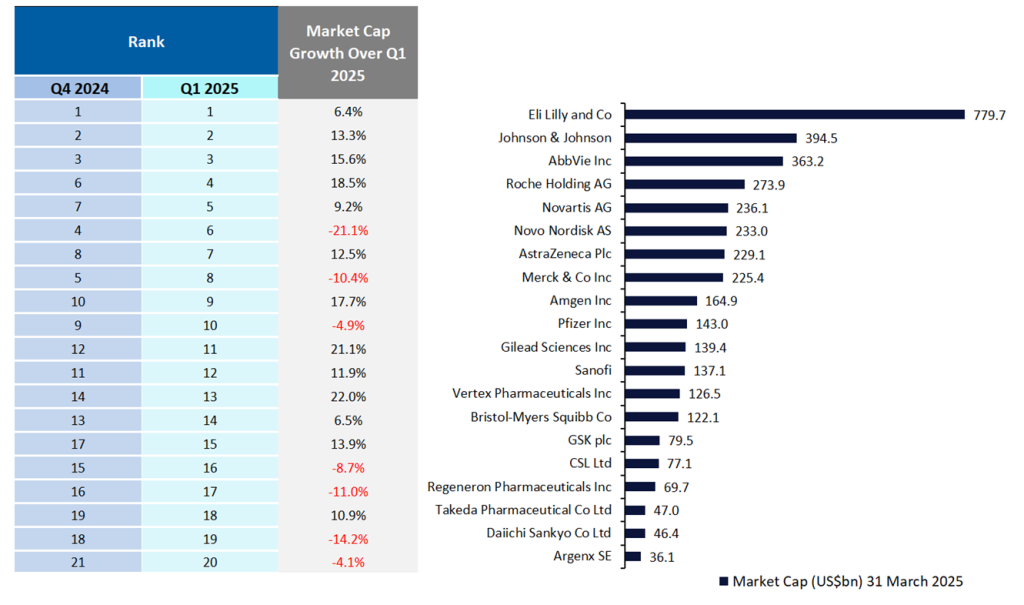

The highest 20 biopharmaceutical corporations demonstrated a powerful begin to 2025, regardless of ongoing uncertainty surrounding the potential affect of President Trump’s proposed pharmaceutical tariffs on international provide chains. Nonetheless, these corporations reported an upturn of 6% in combination market capitalisation from $3.7tn on 31 December 2024 to $3.9tn on 31 March 2025, reveals GlobalData, a number one information and analytics firm.

Determine 1: Prime 20 international biopharmaceutical corporations, by market cap, as of 31 March 2025

Vertex Prescription drugs recorded the very best market capitalisation progress in Q1 2025, rising 22% to $127bn, pushed by robust demand and continued enlargement of its cystic fibrosis portfolio. Vertex just lately obtained FDA approval for Alyftrek (deutivacaftor + tezacaftor + vanzacaftor calcium) in December 2024, adopted by UK MHRA approval in March 2025. Alyftrek provides a next-in-class, once-daily triple mixture remedy to Vertex’s current cystic fibrosis choices. Along with strengthening its cystic fibrosis portfolio, Vertex can be diversifying its pipeline. The FDA’s January 2025 approval of Journavx (suzetrigine), a non-opioid oral ache remedy, additional contributed to the corporate’s market capitalisation progress.

Gilead Sciences witnessed a market capitalisation progress of 21.1%, fueled by promising developments in its HIV portfolio. This contains profitable Section I information for a once-yearly formulation of Sunlenca (lenacapavir) for HIV prevention, constructing on the profitable Section III PURPOSE 1 and a couple of trials of its twice-yearly formulation. The candidate is beneath FDA precedence evaluation, with approval anticipated by mid-2025. Additional strengthening its HIV pipeline, Gilead additionally reported constructive Section III outcomes from the ALLIANCE trial, which evaluated Biktarvy (bictegravir sodium + emtricitabine + tenofovir alafenamide) for sufferers with each HIV and hepatitis B co-infection.

Roche reported an 18.5% improve in market capitalisation attributable to its $5.3bn licensing settlement with Zealand Pharma (in March 2025) to co-develop and co-commercialise petrelintide and a fixed-dose mixture with Roche’s asset, CT-388, marking its enlargement into the cardiovascular, renal, and metabolic house.

Amgen noticed a 17.7% market capitalisation progress, attributed to strong product gross sales, with double-digit progress throughout ten key merchandise. Notable contributors included Repatha (evolocumab) for hypercholesterolemia and hyperlipidemia, Blincyto (blinatumomab) for B-cell acute lymphocytic leukaemia, just lately authorised in June 2024, and Tezspire (tezepelumab-ekko) for extreme bronchial asthma. Amgen’s market capitalisation progress was additional fueled by current constructive Section III information for Tezspire within the WAYPOINT trial in March 2025 for power rhinosinusitis with nasal polyps, and Uplizna (inebilizumab), which is now the primary and solely FDA-approved remedy for immunoglobulin G4-related illness.

Novo Nordisk skilled a 21.1% decline in market capitalisation, regardless of its weight reduction drug Wegovy (semaglutide) producing $2.8bn in This fall 2024—greater than double the gross sales from the identical interval in 2023, based on GlobalData’s Medicine Database Pharma Intelligence Middle. Nonetheless, sluggish gross sales momentum for each Wegovy and Ozempic, mixed with investor considerations over rising competitors from Lilly’s Zepbound, which confirmed superior weight reduction ends in head-to-head trials (20.2% versus Wegovy’s 13.7%), has raised doubts about Novo Nordisk’s market management within the weight reduction market.

Daiichi Sankyo’s market capitalisation fell 14.1% over Q1 2025, following disappointing late-stage outcomes from the Section III TROPION-Lung01 trial. The corporate’s investigational antibody-drug conjugate, datopotamab deruxtecan (Dato-DXd), failed to point out an general survival profit in second-line non-small cell lung most cancers, resulting in the withdrawal of its regulatory utility. Nonetheless, Dato-DXd has since secured its first approval for the remedy of unresectable or metastatic HR-positive, HER2-negative breast most cancers.

Regeneron Prescription drugs registered an 11% market capitalisation decline attributable to involvement in a lawsuit that alleges deceptive pricing practices for its extremely profitable drug, Eylea (aflibercept), for eye ailments.

In the meantime, the ten.4% market capitalisation fall of Merck & Co (MSD) was largely attributable to ongoing investigations and allegations of deceptive security claims associated to its HPV vaccine, Gardasil (human papillomavirus [serotypes 6, 11, 16, 18] [virus-like particle, quadrivalent] vaccine). Nonetheless, Merck efficiently dismissed the plaintiffs’ claims, and Gardasil stays its second-best-selling drug, with $8.58bn in gross sales in 2024, based on GlobalData’s Medicine Database Pharma Intelligence Middle.

The biopharmaceutical trade is positioned for continued restoration, pushed by current FDA approvals and billion-dollar strategic collaborations. Nonetheless, uncertainty stays because the implications of Trump’s proposed pharmaceutical tariffs unfold, elevating considerations over the probability of further rate of interest cuts as the opportunity of greater tariffs is on the horizon. Consequently, trade leaders will proceed to stay cautious throughout these shifting financial situations.

For additional insights into the newest Deal Traits within the Pharma Sector, please see our Enterprise Capital Funding Traits in Pharma – Q1 2025 and M&A Traits in Pharma – Q1 2025 studies.

Navigate the shifting tariff panorama with real-time information and market-leading evaluation.

Request a free demo for GlobalData’s Strategic Intelligence right here.