Managing provide chain challenges for CDMOs

Pharma provide chains are underneath huge stress globally, with geopolitical tensions and the difficulty of tariffs requiring cautious administration by CDMOs.

Historically, transferring manufacturing offshore was a technique to save prices and improve effectivity, with China being a significant location for outsourcing, particularly for lively pharmaceutical elements (APIs).

Nonetheless, as we enter 2026, commerce tensions, significantly between the US and China, have put a substantial pressure on worldwide choices. Moreover, Covid-19 uncovered the dangers of overreliance on worldwide companions, prompting higher adoption of nearshoring to boost provide chain resilience. Whereas in an more and more divided world, the development of friendshoring has elevated as international locations companion with nearer allies.

Points impacting provide chains for CDMOs

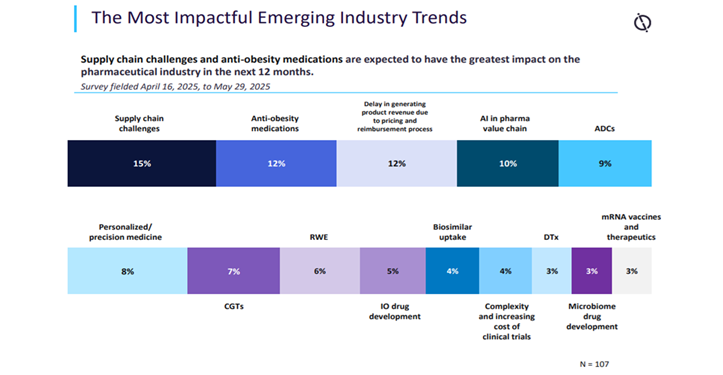

In its mid-year replace, GlobalData’s State of the Biopharmaceutical Trade 2025 features a survey of 107 GlobalData pharma purchasers and prospects, fielded from 16 April 2025 to 29 Might 2025. When requested to establish essentially the most impactful rising trade tendencies anticipated to have the best influence on the pharma sector within the subsequent 12 months, the biggest proportion of respondents, 15%, chosen provide chain challenges. This was up from 8% within the earlier survey, simply six months earlier[i].

This shift is probably going resulting from dangers of recent US tariffs and the tensions with China, creating uncertainty inside manufacturing bases. In December 2025, the BIOSECURE Act was strongly anticipated to grow to be regulation within the US after being handed by each the Home of Representatives and the Senate and is now awaiting ultimate presidential approval.

Earlier drafts took a harsher line on China. Chinese language CDMO WuXi AppTec was previously focused in an earlier model of the act, together with 4 different China-based life sciences firms. But none have been named the model of the laws not too long ago handed. It stays to be seen what influence the laws could have in actuality. Developments shall be intently monitored by the trade.

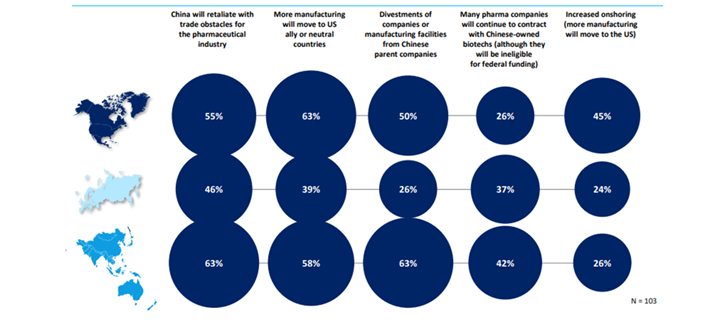

However, the BIOSECURE Act goals to forestall Chinese language producers from accessing US federal funding, particularly concentrating on main Chinese language biotech and genomics firms. The act impacts manufacturing and provide of a number of clinical-stage medicine by US biopharmaceutical firms. Based on the GlobalData survey, many pharma firms had been involved about potential disruption to their provide chains if the act grew to become regulation. Whereas some areas resembling India may gain advantage from elevated enterprise if clients transfer away from Chinese language companions. US pharma depends closely on Chinese language contract producers for lively pharmaceutical elements (APIs) and uncooked supplies because of the low prices and huge manufacturing capability in China. When requested concerning the wider implications of the BIOSECURE Act, the biggest proportion of respondents stated that they anticipated extra manufacturing to maneuver to US-friendly or impartial international locations. There have been additionally excessive numbers of respondents involved about China retaliating.

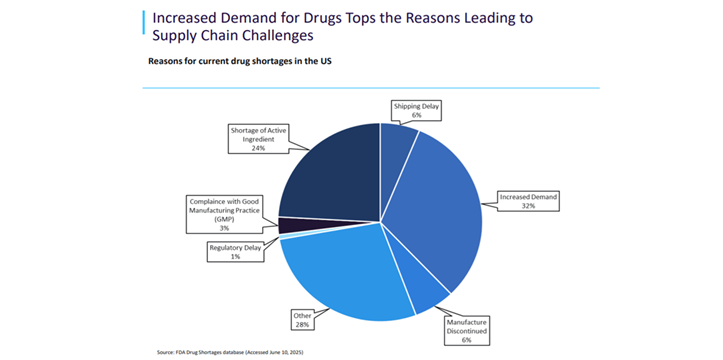

In the meantime, drug shortages are leaving sufferers with out entry to important medicines and healthcare suppliers struggling to seek out options[ii]. Shortages are impacting each excessive and low-value medicine resembling antibiotics, with demand particularly excessive for anaesthetics and oncology medicine. Many producers blame low generic drug costs for shortages, prompting some governments to lift costs to encourage manufacturing.

On the similar time, with the approval of the BIOSECURE Act, US pharma producers are more likely to face growing stress to reshore manufacturing services, strengthen provide chain safety, and reduce their reliance on abroad suppliers.

Why China continues to be very important for pharma manufacturing

China leads the world in chemical manufacturing services for APIs and can be a powerhouse in generic drug manufacturing. Based on GlobalData, China has essentially the most API chemical manufacturing services and API firms on the earth. It’s estimated that the US sources roughly 80% of its API imports from China and India. There are additionally issues rising amongst US policymakers that China might use this dependency as an financial weapon to harm US companies[iii].

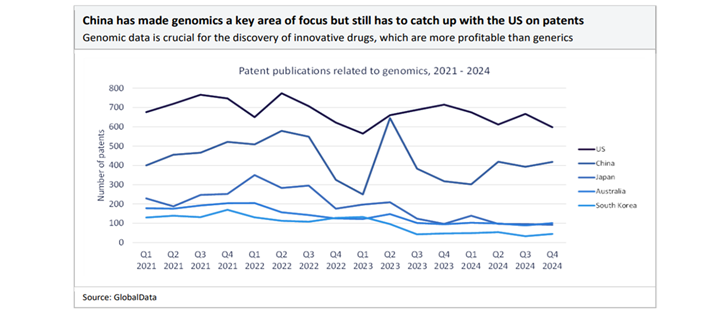

In recent times, China has additionally focussed on progressive drug improvement. With sturdy state help for R&D, coverage incentives, and funding in biotechnologies, China’s pipeline for drug innovation is rising quickly. There was an increase in licensing offers between Chinese language biotechs and overseas pharma throughout 2025, together with a few of the largest offers over the past 5 years happening within the first 9 months of the 12 months[iv].

China now accounts for one fifth of all medicine in improvement, with 28% of the world’s licensed medicine in 2024[v]. The full deal worth of innovator drug licensing agreements involving Chinese language biopharma licensors has surged 66%, from $16.6bn in 2023 to $41.5bn in 2024, reaching a five-year excessive, based on GlobalData’s Pharma Intelligence Heart Offers Database[vi].

Though geopolitical dangers and the “China+1” technique – diversifying manufacturing to different international locations resembling India – are gaining consideration, China’s current infrastructure, provide chain integration, and coverage help nonetheless make the nation a chief world pharma manufacturing hub. China can be bettering its regulatory surroundings, driving high quality and effectivity features. The nation’s pharmaceutical sector is globally recognised, not just for price but in addition for growing high quality and innovation – boosting confidence amongst multinational companions.

Regardless of strikes to diversify provide chains, China’s dominance in low-cost, large-scale APIs and generics manufacturing, fast innovation progress, substantial authorities help, and a substantial home market imply the nation will proceed to stay very important for world pharma manufacturing.

The benefits of onshoring and friendshoring in pharma manufacturing

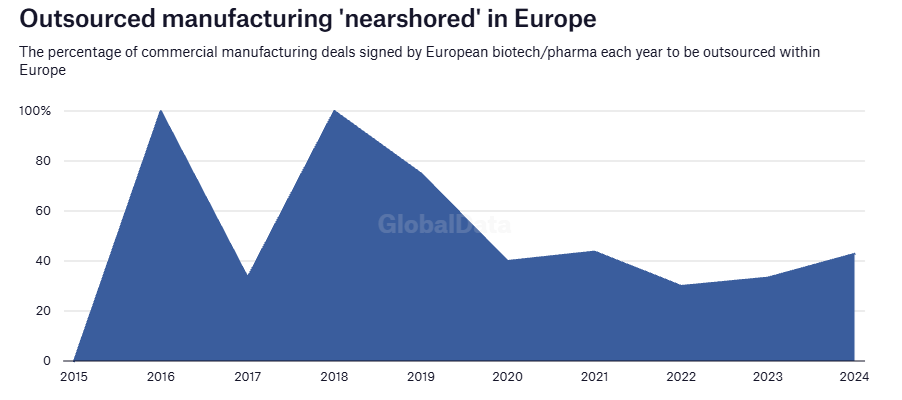

Latest developments within the worldwide panorama have prompted many firms to rethink their provide chain methods, with a rising desire for nearshoring and home operations over conventional outsourcing overseas. Whereas this shift is partly pushed by evolving regulatory and geopolitical pressures, and the perceived want for higher provide chain resilience, some consultants recommend this regionally targeted method could show to be short-term[vii]. Aggressive pressures proceed to current a powerful incentive for firms to keep up worldwide collaboration and operational flexibility.

One other development rising is friendshoring the place international locations and firms swap their provide chains to nations that share both comparable political opinions or safety pursuits. Friendshoring is one other technique to cut back dangers from future geopolitical tensions. Nonetheless, whereas this method could provide elevated safety, it additionally carries the potential for elevated prices and inefficiencies when put next with a totally globalised mannequin, with doable value hikes additional down the road.

Friendshoring has not too long ago grow to be extra vital resulting from drivers such because the US BIOSECURE Act and wider supply-chain realignments post-pandemic. Firms are shifting towards trusted international locations with sturdy regulatory frameworks and expertise swimming pools. One nation the stands to learn from ‘China+1’ methods is India, which is changing into a most popular vacation spot for CDMO companies. That is enabling biopharma sponsors to diversify danger, entry specialised assets, and improve the pace of recent therapies to market whereas making certain a strong, dependable provide chain.

Danger mitigation methods delivering profitable outcomes

When it comes to danger mitigation, the main focus is on broad geographic diversification, making certain suppliers and operations are distributed throughout steady and ‘pleasant’ areas. The China+1 technique, as an illustration, has made India significantly engaging to sponsors owing to its aggressive pricing, extremely expert workforce and agility. Shifting manufacturing nearer to main markets in North America and Europe reduces regulatory and logistical dangers and circumvents uncertainties related to laws impacting overseas suppliers – such because the BIOSECURE Act. In anticipation of potential future disruptions, US and European CDMOs are increasing their capability to serve purchasers seeking to keep away from China-related provide chain dangers.

The BIOSECURE Act prohibits US corporations from partnering with sure Chinese language biotechnology firms. To mitigate the influence of this laws, trade consultants suggest that firms incorporate termination rights and expertise switch provisions inside their contracts. Moreover, superior planning is crucial, with firms inspired to develop backup plans that set up relationships with non-Chinese language CDMOs and to spend money on scaling up US or European operations. The considering is that this may guarantee enterprise continuity and regulatory compliance[viii].

CDMOs are additionally fortifying their provide chains by means of a collection of sensible measures. These embrace establishing contracts with a number of suppliers to safe materials availability and sustaining stock buffers to handle disruptions. Whereas digital monitoring instruments enable for real-time provide community oversight.

Piramal Pharma Options (PPS)

Piramal’s provide chain technique relies on shopper wants, supported by agile processes and fashionable expertise that facilitate oversight throughout all the worth chain. With services spanning India, the UK, and the US, Piramal is strongly positioned to reply to any disruptions which may have an effect on particular areas. The corporate’s broad portfolio ranges from KSMs and APIs to completed dosages and specialised programmes resembling ADCelerate. These specialist companies help purchasers in addressing various therapeutic necessities.

For instance, Piramal was tasked with fulfilling a rush order of a vital uncooked materials in 4 months. The shopper grew to become conscious on the final minute of patent restrictions, which meant a Chinese language provider was not authorised to promote a vital uncooked materials. Piramal switched to a significant specialised chemical compounds provider, which transferred the product to India and provided the required amount inside three months – all with none patent points.

Piramal’s provide chain method – rooted in agile, technology-driven oversight and a worldwide, diversified footprint – offered a fast, compliant response to an surprising disruption. The outcome was safeguarding the shopper’s timeline and regulatory necessities.

To strengthen resilience amid world provide chain shifts, CDMOs resembling Piramal are adopting agile methods – together with nearshoring and provider diversification – to make sure continuity and compliance, whereas lowering danger regardless of the geopolitical disruptions.

To be taught extra concerning the firm’s companies, obtain the doc beneath.

References:

i. GlobalData: The State of the Biopharmaceutical Trade 2025 Version, January 2025.

ii. https://www.bbc.co.uk/future/article/20251021-why-youre-having-trouble-getting-your-meds

iii. GlobalData: Strategic Intelligence Expertise: China Tech, April 15, 2025 (web page 33).

iv. https://www.pharmaceutical-technology.com/information/chinas-drugs-offer-lifeline-for-global-pharma-as-it-peers-over-the-patent-cliff/

v. https://www.pharmaceutical-technology.com/information/china-accounts-for-one-fifth-of-global-drugs-in-development/

vi. https://www.pharmaceutical-technology.com/analyst-comment/large-pharma-drug-licensing-china-2024/

vii. https://www.pharmaceutical-technology.com/options/are-european-biopharma-manufacturers-nearshoring/

viii. https://pharma.globaldata.com/Information/biosecure-act-companies-turn-to-us-manufacturers_218816