How Well being Insurance coverage Can Save You Cash on Medical Payments in Ghana

Safe Your Well being, Save Your Cash: A Information to Selecting the Proper Well being Insurance coverage in Ghana

Medical health insurance in Ghana provides useful monetary safety, permitting residents to entry important healthcare providers with out the burden of overwhelming prices. As healthcare bills proceed to rise globally, having a strong medical insurance plan is more and more very important to keep away from sudden medical payments.

On this information, we’ll discover the perfect medical insurance choices out there in Ghana, focus on the advantages of medical insurance coverage, and supply a step-by-step information on how to enroll.

We’ll additionally delve into personal healthcare choices and the way they complement public medical insurance plans. Whether or not you are centered on household well being, health, or just making certain entry to high quality well being providers, this text will provide help to make knowledgeable choices about medical insurance in Ghana.

Finest Well being Insurance coverage in Ghana

Choosing the proper medical insurance plan is important for safeguarding your well being and funds. In Ghana, each private and non-private medical insurance choices can be found, catering to completely different wants and budgets.

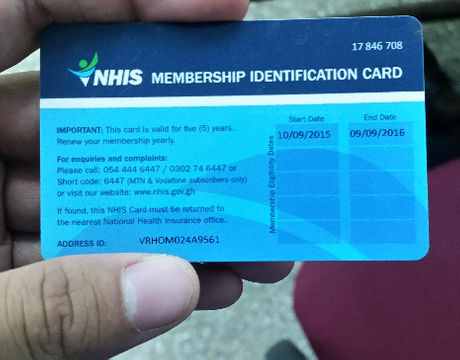

Nationwide Well being Insurance coverage Scheme (NHIS):

The NHIS, launched in 2003, is Ghana’s major public medical insurance choice. It provides reasonably priced entry to fundamental healthcare providers, overlaying outpatient and inpatient therapies, maternity providers, and emergency care.

Nonetheless, there are particular limitations to NHIS protection, akin to high-cost therapies for most cancers and a few surgical procedures. For a lot of Ghanaians, the NHIS offers a foundational layer of healthcare help, notably helpful for frequent illnesses and routine well being providers.

High Non-public Well being Insurance coverage Suppliers in Ghana:

-

Premier Well being Insurance coverage – Identified for its complete plans, Premier Well being Insurance coverage caters to each people and company purchasers, providing a variety of protection choices. Premier’s versatile plans make it a pretty alternative for these searching for in depth healthcare protection and specialised providers.

-

Acacia Well being Insurance coverage – Acacia is a number one supplier in Ghana, acknowledged for its aggressive packages and fast response instances. Their protection contains outpatient care, maternity providers, and different well being advantages splendid for households and people centered on holistic wellness.

-

GLICO Healthcare – With a status for dependable service, GLICO provides sturdy plans overlaying each inpatient and outpatient providers. Its in depth community of service suppliers throughout Ghana ensures accessible and well timed care.

These personal insurers permit for extra versatile choices tailor-made to distinctive healthcare wants. They typically embrace further providers not lined by NHIS, akin to specialised medical consultations and faster entry to elective procedures.

Medical Insurance coverage in Ghana

Medical insurance coverage in Ghana, encompassing each private and non-private schemes, performs a crucial position in offering monetary reduction from excessive healthcare bills. Whereas NHIS operates on a contributory foundation with premiums primarily based on earnings ranges, personal insurance coverage require a month-to-month premium and supply added advantages, akin to entry to specialists and shorter wait instances.

Key Advantages of Medical Insurance coverage Plans in Ghana:

- Inpatient Providers: Overlaying hospital stays, surgical procedures, and associated therapies.

- Outpatient Providers: Offering protection for consultations, diagnostics, and minor procedures.

- Maternity Care: Encompasses prenatal and postnatal providers, making certain complete look after moms and newborns.

- Emergency Providers: Ensures protection for pressing care conditions requiring instant medical consideration.

Professional Tip: When deciding on a medical insurance coverage plan in Ghana, take into account your healthcare priorities, akin to persistent sickness administration, health help, or preventive providers. For example, these eager on health might profit from plans that supply wellness checks, physiotherapy, or protection for routine well being screenings.

Well being Insurance coverage Plans: What to Look For

Deciding on the best medical insurance plan requires a cautious evaluation of your healthcare wants, monetary capability, and out there choices. Listed below are some important elements to contemplate when selecting medical insurance in Ghana:

-

Protection Choices – Assessment the vary of providers included, notably when you have particular healthcare wants. For example, if health and wellness are your focus, search for plans that supply common well being screenings and exercise-related harm care.

-

Premium Prices – Make sure that the premium is reasonably priced inside your price range. NHIS provides a lower-cost public choice, whereas personal insurance coverage include month-to-month premiums that will range considerably primarily based on the extent of protection.

-

Community of Suppliers – Test in case your most popular hospitals, clinics, and specialists are included within the insurance coverage supplier’s community. This may guarantee you may entry the services you belief.

-

Declare Course of – Be taught in regards to the claims process for every plan. A simple declare course of will make it simpler to obtain reimbursements or direct billing for providers with out problem.

Fashionable Well being Insurance coverage Plans Comparability Desk:

| Supplier | Protection Kind | Key Advantages |

|---|---|---|

| NHIS | Public | Inexpensive fundamental healthcare; exemptions for weak teams |

| Premier Well being Insurance coverage | Non-public | Complete protection with a cellular app for claims |

| Acacia Well being Insurance coverage | Non-public | Aggressive packages with fast service |

| GLICO Healthcare | Non-public | Intensive supplier community and dependable service |

These comparisons can function a fast reference for these exploring choices to search out the perfect match for his or her healthcare and health wants.

Non-public Healthcare in Ghana

Whereas public healthcare is extensively out there in Ghana, personal healthcare provides further advantages for these prepared to spend money on extra customized providers. Non-public healthcare services are sometimes most popular resulting from shorter wait instances and extra centered affected person care. Nonetheless, these providers are typically pricier, making medical insurance a necessary software for lowering prices.

Advantages of Non-public Healthcare:

- Sooner Entry: Non-public healthcare services usually have shorter wait instances, permitting you to obtain well timed remedy.

- High quality of Care: Many personal hospitals are outfitted with state-of-the-art services and extremely educated specialists.

- Personalised Providers: With fewer sufferers per physician, personal services typically present extra consideration to every affected person, enhancing the standard of care.

Tip for Health Fans: If health and wellness are integral to your life-style, personal medical insurance can provide you entry to sports activities drugs and physiotherapy providers, which is probably not absolutely lined underneath NHIS.

The best way to Signal Up for Well being Insurance coverage in Ghana

Signing up for medical insurance in Ghana can appear advanced, however the course of is pretty simple when you perceive the steps:

-

Decide Eligibility: Primarily based in your earnings degree and well being wants, resolve whether or not you qualify for NHIS or would profit extra from personal insurance coverage. NHIS offers exemptions for sure teams, like seniors over 70 and youngsters underneath 18.

-

Select a Plan: Analysis completely different plans from each private and non-private insurers. Consider primarily based on protection, affordability, and supplier community to make sure the plan matches your healthcare and health objectives.

-

Collect Required Paperwork:

- For NHIS: A legitimate ID (like a Ghana Card), passport-sized photographs, and proof of residence.

- For Non-public Insurance coverage: Identification paperwork and any further info requested by the insurer.

-

Full Utility Varieties: Full your software on-line or go to an area NHIS workplace or a non-public insurance coverage supplier’s department.

-

Pay Premiums: For NHIS, premiums are income-based, whereas personal insurance coverage entails common month-to-month funds. Guarantee well timed premium funds to keep away from a lapse in protection.

-

Obtain Your Card/Coverage Doc: As soon as processed, you’ll obtain an NHIS card or a coverage doc out of your personal insurer, formally granting you entry to healthcare providers underneath the plan.

Bonus Tip: For these focused on preventive care and health, inquire in case your plan covers wellness applications, health lessons, or entry to fitness center services. Some personal medical insurance suppliers supply reductions on well being and health providers as a part of their wellness incentives.

Conclusion

Medical health insurance in Ghana is greater than only a security web—it’s an important software for managing healthcare prices, making certain entry to important well being providers, and selling long-term well-being.

By evaluating choices like NHIS and personal medical insurance suppliers akin to Premier Well being Insurance coverage, Acacia Well being Insurance coverage, and GLICO Healthcare, Ghanaians can select plans that align with their well being, health, and monetary wants. With the best insurance coverage, you’re not solely investing in your instant well being but in addition securing your future.

Whether or not you’re centered on sustaining health, accessing specialised well being providers, or safeguarding in opposition to excessive medical payments, medical insurance in Ghana offers the pliability and help needed to guide a wholesome life with confidence.

FAQ Part:

1. How a lot is medical insurance in Ghana?

The price of medical insurance in Ghana is determined by the kind of protection you select. For the Nationwide Well being Insurance coverage Scheme (NHIS), premiums are comparatively reasonably priced and primarily based on earnings teams. Sometimes, NHIS premiums vary from as little as GHS 30 to GHS 180 yearly, relying on the subscriber’s earnings and age.

Non-public medical insurance plans usually have greater premiums, with prices various primarily based on the extent of protection and advantages offered. Premiums for personal plans can vary from GHS 100 to GHS 1,000 or extra yearly, relying on the supplier and the chosen bundle.

2. The best way to verify Ghana Nationwide Well being Insurance coverage?

To verify your Ghana Nationwide Well being Insurance coverage standing, you should use the NHIS web site or the cellular app. You’ll must log in utilizing your NHIS card quantity or the distinctive identification quantity linked to your registration.

You can even go to any NHIS district workplace to confirm your registration or verify the validity of your NHIS membership. Moreover, healthcare suppliers can verify your membership standing on their system whenever you go to their services.

3. The best way to register for Ghana Well being Insurance coverage?

Registering for Ghana Well being Insurance coverage (NHIS) is an easy course of. To register, comply with these steps:

- Go to an NHIS workplace in your space or register on-line through the official NHIS web site.

- Submit required paperwork akin to a legitimate ID (Ghana Card, passport, or beginning certificates for minors), passport-sized photographs, and proof of residence.

- Full the registration type and pay the required premium primarily based in your earnings group or standing.

- Obtain your NHIS card, which you should use to entry healthcare providers underneath the scheme.

Alternatively, registration is out there at approved brokers, cellular registration facilities, and district places of work throughout the nation.

4. What number of kinds of medical insurance are there in Ghana?

In Ghana, there are two most important kinds of medical insurance:

- Nationwide Well being Insurance coverage Scheme (NHIS): A public medical insurance scheme that covers fundamental well being providers for all Ghanaian residents and authorized residents. It contains protection for outpatient and inpatient care, maternal providers, and a few emergency providers.

- Non-public Well being Insurance coverage: Supplied by personal firms akin to Premier Well being, Acacia Well being, and GLICO Healthcare, these plans present extra complete and versatile protection. Non-public medical insurance plans typically cowl a wider vary of therapies, together with elective surgical procedures and specialist consultations, which is probably not absolutely lined by NHIS.